21 Extreme Frugality Tips That’ll Save You THOUSANDS This Year

This post may contain affiliate links. If you decide to purchase through my links, I may earn a small commission. Read my disclosure page for more info.

You probably know all the standard ways to save money:

Buy things on sale, don’t eat out as much, make a budget, try to lower your bills, etc.

But if you’re really needing to save some money, then those ordinary measures might not get you as far as you need.

So you have to up the ante, so to speak, and find more extreme ways to save money without having to downsize your house or eat ramen all the time.

By incorporating just a few extreme frugality tips into your lifestyle, you can meet your savings goals, get out of debt, and start investing for your future.

Here are my top 21 extreme frugality tips that’ll save you thousands of dollars per year.

And don’t worry, they’re totally doable!

Incorporate a few of these with my 75 easy frugal hacks cheat sheet, and you’ll be on your way to a better financial future!

Related Read: 75 Easy Frugal Living Tips with a BIG Impact

What is extreme frugality?

Before we dive into some extreme frugality tips, let’s first unpack what exactly extreme frugality means.

According to the Merriam-Webster dictionary, frugality is:

“the quality or state of being frugal: careful management of material resources and especially money”

Therefore, extreme frugality is the management of money and material resources beyond what the ordinary or average person does.

Examples of Extreme Frugality

At this point in time, you may or may not know someone who takes cutting expenses to the extreme. Maybe it’s a friend who strictly eats only home-cooked meals, or a colleague that refuses to drive, opting instead for public transport or cycling, no matter the distance.

Here are a few more examples of what extremely frugal people might do:

- They grow and make all their own food at home.

- They almost exclusively seek out free used items online (Craigslist, Facebook Marketplace)

- Extremely frugal people don’t shop sales to save a few bucks like the rest of us. They opt not to shop at all.

- They refuse to spend money on any unnecessary and/or new items.

- An extremely frugal person will attempt the do-it-yourself route before either hiring someone to fix or repair an item or buying a new one.

Now, hopefully these examples don’t actually sound too far-fetched or impossible, because all of us should be reducing our spending and consumption to not only save our wallets, but also our planet.

Which brings us to the next point…

Why should you be extremely frugal?

As you’ll soon discover, extreme frugal living isn’t for everyone, and nor should it be!

We all have different lifestyles, incomes, and necessary expenses. And perhaps most importantly: we all enjoy buying certain items because they bring us happiness.

However, just because you can’t change your entire way of living, doesn’t mean we all can’t learn a thing or two from extremely frugal people.

So what exactly can we learn?

As it turns out, quite a bit!

Frugal living, be it extreme or not, can help us:

- Save more money.

- Stick to our monthly budget.

- Give us financial stability (we can save up a rainy day and emergency fund).

- Pay off our debt.

- Retire early.

- Live more eco-friendly.

Whether you adopt just a few frugal hacks or all of them, frugal living can help you do more than just save money. It can transform your financial present, future, and reduce your environmental impact.

21 Extreme Frugality Tips to Save Money

1. Use free gift cards when buying things.

There’s no better way to save your own money, than getting free money from someone else.

Now, imagine if some or even all of your everyday purchases were paid for using this free money. You would save a ton.

Which brings us to the first extreme frugal hack: making free gift cards cover your expenses.

With rewards programs like Swagbucks, Inbox Dollars, and Survey Junkie, you can take surveys, play games, watch videos, and even read emails to earn money.

It sounds crazy easy, because it is. All 3 of these money saving tools offer legit ways to get paid in gift cards for doing simple tasks online.

Then, the Amazon, Paypal, Walmart, Target (and more!) gift cards can cover your grocery expenses and more.

Check out:

- Swagbucks — Read emails, shop online, take surveys, play games, and watch videos to earn money via Paypal or gift cards to some of your favorites online retailers, including Amazon. Sign up for a $5 bonus!

- Inbox Dollars — You can make money online in a variety of ways, like reading emails, watching videos, shopping online, and taking surveys. Get an INSTANT $5 bonus when you sign up for Inbox Dollars today!

- Survey Junkie — Survey Junkie works with a few different survey websites and market research companies. It’s simple: you take surveys, and get cash or gift cards to your favorite places like Amazon, Walmart, iTunes, and more. So while you’re sitting on the subway or pausing between episodes of a TV show, you can start getting paid.

Related Read: 13 Highest Paying Survey Sites to Get FREE Gift Cards

Earn with Swagbucks

Get paid in gift cards or Paypal cash for taking surveys, playing games, or just shopping online! Earning extra money has never been easier.

2. Hunt down coupon and cash back opportunities.

I say “hunt down” because, to be really frugal, you can’t wait for coupons to come to you.

Extremely frugal people will proactively cut and save coupons from magazines, use coupon-finding apps like Honey, and keep an eye out for sales at local stores.

And coupled with this, very frugal individuals will only buy things that they actually need.

So it’s important that you hunt for and use coupons on items you need to purchase.

Similar to coupons, cash back rewards apps are very popular these days, with people earning millions in cash back each year.

Here are the best 3 apps to earn cash back:

- Rakuten (formerly Ebates) lets you shop online or in-store and earn up to 40% cash back at over 2,500 stores. You simply download the app onto your phone or use the browser extension on your computer while you shop. For signing up with Rakuten today, you can get a nice $10 instant bonus!

- Ibotta lets you earn cash back on both in-store and online shopping. If you’re shopping in-store, you can pay using the Ibotta app to earn instant cash back on your purchase. Or, if you pay using a different method, you can scan your receipt to get cash back too! Sign up today to get a welcome bonus of $20!

- Swagbucks is another program that’ll give you cash back. You earn by doing your normal online shopping, taking surveys, watching videos, playing games, and simply searching the web. Sign up today and you’ll receive a $5 bonus!

3. Start a garden.

Another extreme frugality idea is to grow your own backyard garden.

In your garden, you can grow your own fruits, vegetables, and herbs, so that you don’t have to spend money on these at the grocery store.

Also, growing your own garden is a great way to eat healthier and live more sustainably.

Find out how you can start a home garden from scratch over at Attainable Sustainable.

4. Make your own bread.

Anyone else a fan of The Great British Bake Off?

If so, then you know that baking bread ain’t no walk in the park…And that’s exactly why this is yet another great frugality tip for those of us ready to get extreme.

It’s easy to dismiss the cost of bread, but with the average American consuming 53 pounds of bread per year, you can’t deny the money-saving opportunity here.

The cost of the ingredients to make bread are much lower than the already-made loaf you’ll get at the grocery store.

By some estimates, making your own bread can save your family between $320 to $1,280 per year!

5. Make your gifts to others.

With birthdays, Mother’s Days, Father’s Days, Christmas, and more…gift giving can get quite out of hand and rack up enormous annual costs.

So extremely frugal people will make their gifts to others instead!

Some DIY, craft, and homemade gift ideas include:

- Baked items

- jams and marmalades

- Candy

- Candles

- Knitted items

- Clothing

- art/paintings/drawings

- Ceramics

And if you’re looking for even more frugal gift-giving inspiration, the Spruce Crafts has over 100 homemade gift ideas!

6. Stop buying clothes.

Ladies, there comes a point where we do, in fact, have enough clothes.

I’ve personally gone from spending around $600 a year on new clothes, to not buying clothes for almost 2 years! So this extreme frugality tip has saved me over $1200 at this point. Woah!

I know NOT buying clothes sounds crazy, but when you think about it, fashion doesn’t really change that much within a year or even a couple years. I’m sure you’re still wearing sweaters, jeans, and t-shirts that you’ve had a long time too!

So make sure your closet has those wardrobe staples and items for every season…and then STOP—You’ll watch your savings grow!

Related Read: 21 Things I Stopped Buying to Save $100k

7. Use reusable menstrual products.

Thankfully, this extreme frugal hack has gone mainstream in recent years as younger generations are seeking out alternatives to disposable tampons and pads in favor of newer, innovative feminine products.

And did you know:

For a woman using disposable menstrual products, she will spend an average of $1,773 on tampons, and $443 on pads and panty liners in her lifetime!

And not to mention the environmental impact all of those products will have…

So make your cycle more eco-friendly and frugal by purchasing reusable menstrual products, such as:

- Weegrecco 6 Pack of Reusable Charcoal Bamboo Cloth Sanitary Pads

- Diva Cup – Leak-Free BPA-Free Menstrual Cup

- Innersy 3 Pack Ultra-Soft Period Underwear

Related Read: 55 Clever Products That’ll Save You Money in The Long Run

8. Use cloth diapers.

The diaper-era may seem like it flies by as the kiddos grow so fast, but those diapers still cost a lot of money!

So a great, frugal way to save money before potty-training time, is to use washable cloth diapers.

Reusable diapers, like these from Ammababy, are waterproof and machine washable, which means you’ll no longer be throwing money into the garbage, literally!

9. Turn off the AC or heat, and dress accordingly.

Extremely frugal people cut costs wherever they can, and that includes during the summer and winter months when most of us blast the air conditioning and heat.

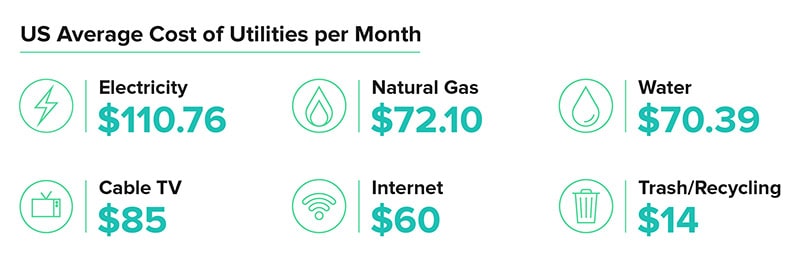

According to Move.org, the average cost of energy in US households is over $1400 per year, and with this extreme frugality tip—you can cut that expense in half!

Instead of blasting the air conditioning as soon as the weather starts to warm up, open some windows, draw the curtains in rooms you’re not using, and save the A/C for mid-summer when you really need it.

And during the winter, bust out those sweaters, cozy socks, and hoodies rather than upping the heat all the time.

Essentially, extreme frugal living means adjusting to the actual climate, not a year-round 74 degree home.

10. Don’t use a car.

Another extreme frugal way to save money is by not using, or even owning, a car.

Cars are expensive. Because not only do you have monthly car payments or a thousands-of-dollars price tag, but you also have to pay for car insurance, gas, maintenance, repairs, parking, etc.

So especially if you live in a city or town with good public transportation, why not use it and save money and the CO2 emissions?

You can also buy a foldable bike for commuting and taking public transit when needed, like when it rains or snows. This Schwinn Adult Folding Bike is a fraction of the monthly cost of a car, and it’s a one-time purchase!

For those of you living in more suburban and rural areas, think about carpooling with friends to work or buying an electric bike like this popular Ancheer Electric Bike that can go up to 20 mph.

Buying a new bike might seem like you’re spending a lot of money, but just remember all those associated costs of owning a car that you’re reducing or eliminating. You’re spending a bit now, to save a TON later!

11. Do a no-spend challenge.

Like we said before, extreme frugality is taking ordinary money-saving habits and making them extra-ordinary.

And going that extra mile means not spending ANY money.

At first glance, this may sound absolutely inconceivable, but in reality:

Not spending any money is as easy as doing a no-spend challenge.

A no-spend challenge is where you choose a length of time—it could be a weekend, week, or month—and try to either not spend any money, or not spend money on anything other than necessary expenses, such as housing, utilities, food, etc.

No-spend challenges can be tailored to fit whatever savings and money goals you have. I’ve done numerous no-spend challenges over the years, including a “no-spend at Starbucks month” (yes, I’m addicted) and a “don’t-spend on any unnecessary expenses month”.

I highly recommend you try a no-spend challenge to kickstart your money goals and keep your purchasing habits in check. Start easy, with a no-spend weekend and see how you do. Every penny you save, counts!

Take a look at my in-depth post on how to rock a no-spend challenge to see how you can get started!

12. Get freebies through Amazon direct ship.

There are tons of different ways to get free products—you just have to put in the effort to make it happen.

Direct shipping from Amazon sellers is just one of those ways to get free Amazon products delivered to your door.

Amazon direct shipping is where Amazon sellers clear out excess warehouse inventory and send products straight to consumers. This helps them avoid paying long-term storage fees and other charges on products that haven’t sold.

So what better way to live frugally than getting free stuff?

To find out how you can get free Amazon products, check out my Amazon Direct Ship Ultimate Guide!

13. Get free Starbucks drinks.

The average cost of a Grande Americano at Starbucks is $2.95. If you buy one of those even 3 times a week, that’s a yearly cost of $460.20.

And let’s be honest, most of us don’t go to Starbucks just for their Americanos. We’re typically getting food as well, and dare I say it:

Pumpkin spice lattes. Mmm…

So really, we’re probably spending closer to $1000 per year on Starbucks.

Now, to live really frugally, you’d probably cut out Starbucks all together, but I’m won’t dare to suggest that because there’s actually a better alternative:

With rewards programs like Swagbucks, Rakuten, Ibotta, and Survey Junkie, you can do simple tasks online and earn Starbucks gift cards or Paypal money!

Then, you can save money and still drink pumpkin spice lattes too. Umm, yes please!

See how you can start earning free gift cards and Paypal money at:

- Swagbucks is another cash back program that pays in gift cards as well. You earn by doing your normal online shopping, taking surveys, watching videos, playing games, and simply searching the web. Sign up today and you’ll receive a $5 bonus!

- Rakuten (formerly Ebates) lets you shop online or in-store and get free gift cards or up to 40% cash back at over 2,500 stores. You simply download the app onto your phone or use the browser extension on your computer while you shop. For signing up with Rakuten today, you can get a nice $10 instant bonus!

- Ibotta lets you earn cash back and gift cards by shopping both in-store and online at your favorite retailers. If you’re shopping in-store, you can pay using the Ibotta app to earn instant cash back on your purchase. Or, if you pay using a different method, you can scan your receipt to get cash back too! Sign up today to get a welcome bonus of $20!

- Survey Junkie — Survey Junkie works with a few different survey websites and market research companies. It’s simple: you take surveys, and get cash or gift cards to your favorite places like Starbucks, Amazon, Walmart, iTunes, and more. So while you’re sitting on the subway or pausing between episodes of a TV show, you can start getting paid.

Related Read: 11 Hacks to Get FREE Starbucks Drinks

14. Water down soap and dish soap.

This nifty little frugal hack can save you a decent amount of money over the long-term.

Instead of throwing away that hand soap and dish soap bottle when you can’t pump out anymore, fill it with a bit of water!

That way, you’ll get every last drop of soap out of the dispenser and still get your hands or dishes nice and clean.

15. Use free hotel soaps and shampoos.

I actually learned this extreme frugal tip from my mom!

Every hotel we’d stay in, she’d keep all of the complimentary shampoos, soaps, and toothbrushes. Then, she’d put them in a cute basket in the guest bathroom or bedroom, so that when people stayed over they had toiletries to use!

Pretty brilliant!

So next time you go on a vacation or business trip, keep whatever complimentary toiletries the hotel provides. After all, it’s free stuff!

16. Make your own laundry detergent.

Laundry detergents are not only expensive, but also contain loads of chemicals that can trigger allergic reactions and have even been linked to cancer.

So save your money and your health by making your own laundry detergent at home!

Check out Wellness Mama’s guide to making your own laundry detergent at home.

17. Make your own shampoo.

Ladies, we go through a heck of a lot of shampoo in a year, let alone a lifetime.

And like laundry detergent, a lot of store-bought shampoos come loaded with chemicals and ingredients neither you or I can even pronounce.

So a great frugal way to save your hair, skin, and wallet is by making your own shampoo at home.

And again, Wellness Mama has a great tried-and-true recipe for homemade shampoo that’s worth checking out.

18. Join the no-poo movement.

Or, if you want to really save money on hair products, then join the no-shampoo movement!

The premise is pretty simple:

Stop using shampoo to wash your hair.

I mean, think about it: Did our ancestors use Herbal Essences or expensive salon shampoos every day? If not, then why are we so dependent on these expensive, chemical-ridden products?

There’s a growing chorus for abandoning shampoo in favor of all-natural cleaners like baking soda or even just water alone.

19. Color and cut your own hair.

Every time we go to the salon for a cut and color, it’s hard to leave without spending a whopping $80-$120 each time.

And assuming you’re getting your hair cut, dyed, and highlighted multiple times per year, then you’re spending a ton of money.

So instead of having these expenses, extremely frugal people will cut and color their own hair or have a friend or partner do it. This alone saves them hundreds of dollars per year.

20. Rent out a room.

Chances are, your guest bedroom remains empty the majority of each year.

And while that guest bed duvet gathers dust, you’re missing out on some extra income you could be earning every month.

Making money off the spare rooms in your house is easy with Airbnb, especially if you live close to major cities that bring tourists from around the globe. You can earn a couple hundred bucks per month, and maybe even a thousands each year.

21. Groom your pets yourself.

Oh pooches and kitties, we love you so. But grooming all that fur ain’t cheap!

The average cost to get a dog groomed, for example, is between $30 and $90 each and every time!

So if you’ve mastered the art of cutting your own hair, then maybe it’s time to tackle your furry friend.

You’ll just need a few items to get you started:

- For grooming large dogs, check out this 30-inch Fold-Up Grooming Table that costs less than a single trip to the groomers for your big boy/girl.

- For small dogs and cats, this small grooming table fits perfectly on any countertop.

- And to groom like a pro, this Ceenwes Pet Grooming Kit comes with a rechargeable hair trimmer, 4 different comb attachments, nail clippers, a stainless steel comb and scissors, and more!

How to Be Extremely Frugal

So you’ve read through these extreme frugality tips, and hopefully some of them aren’t too far-fetched for you to adopt.

Again, it’s not about doing all of these things. It’s about finding many small ways to save money here and there.

So how do you start living frugally?

Here are my 5 best tips to help you start your new frugal living lifestyle:

- Create a monthly budget and stick to it. Budget your income correctly, so that you set yourself up for success.

- Try as many frugal living tips as you can, and keep the ones that suit you best.

- Do no-spend challenges to recalibrate your spending habits and save more money.

- Boost your income through side-hustles and easy ways to make money online.

- Don’t give up! Living more frugally isn’t a switch you can just turn on—you have to make it a habit by being thrifty over a longer period of time.

Best Resources to Live More Frugally

In your journey towards a more frugal lifestyle, it’s important to stay motivated, inspired, and always keep your eyes on the impact frugal living has both on your money and the planet.

So here are some of my favorite, inspiring books and resources to help you embrace the frugal life:

- Meet the Frugalwoods: Achieving Financial Independence Through Simple Living

- Simply Living Well: A Guide to Creating a Natural, Low-Waste Home

- The More of Less: Finding the Life You Want Under Everything You Own

- The Complete Tightwad Gazette: Promoting Thrift as a Viable Alternative Lifestyle

Want more ways to save money? Check out these other posts: