How I Paid Off $55,277 in Student Loans and Traveled the World

This post may contain affiliate links. If you decide to purchase through my links, I may earn a small commission. Read my disclosure page for more info.

After really focusing on my student loan debt, I paid off $55,277 off student loans within 3 years.

However, if you’re like me you probably didn’t get serious about paying off your student loans right after graduation. After all, you can just make the minimum payments and then all will be forgiven in 20-25 years, right? Why worry about it?

Stop right there. Although tempting, this is NOT the mindset you should have.

Be proactive about getting out of debt, find simple ways to save money everyday, and take action. The sooner you do, the sooner you can start saving for retirement. (And no, that’s not just for older people to worry about.)

What makes getting out of debt so difficult is capitalized interest. You’re throwing the minimum payment at your loans and you’re not even making a dent.

When I saw this, I came to my senses and realized that compound/capitalized interest was going to keep me saddled with debt for infinity.

That was when I started making strategic moves to pay off my loans so that I could spend money on the things (travel) that matter to me.

The first step in paying off loans is understanding the enemy. You need to familiarize yourself with how interest accrues and understand your repayment and refinancing options.

Then, you can start eliminating that debt faster.

So take a look at some things I did that allowed me to pay off $55,277 of student loan debt and travel the world.

How I Paid Off My Student Loan Debt – 7 Tips to Being Debt FREE

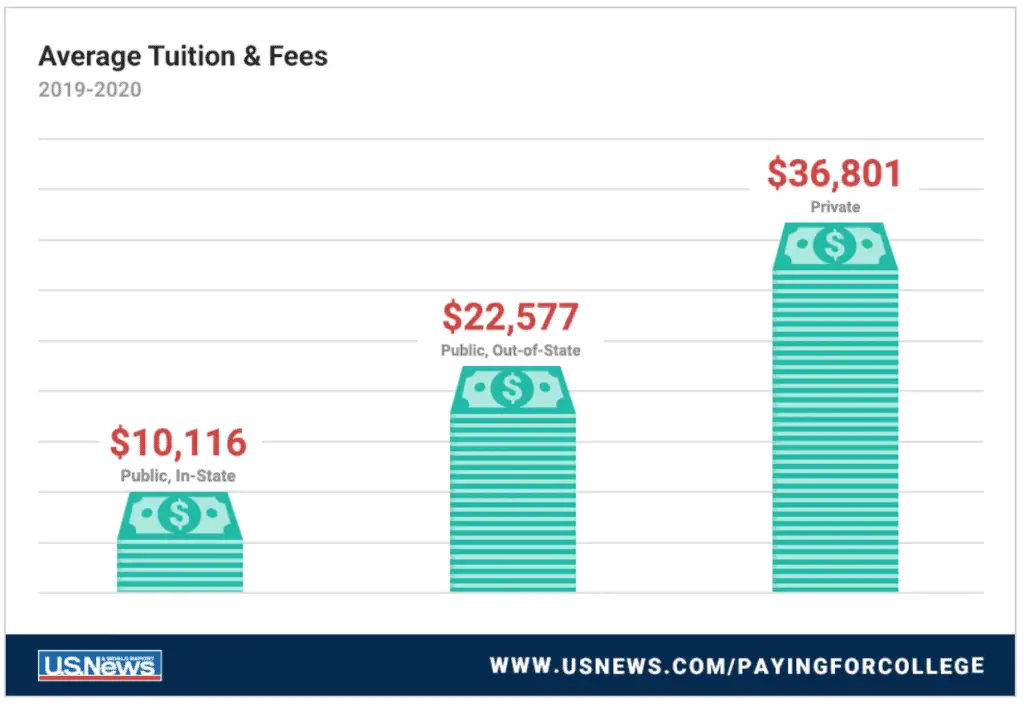

1. Attend community college.

Some of you may not be able to benefit from this tip because you’ve already graduated and your loan debt is what it is. Ugh.

But for those of you about to enter college and wanting to avoid a post-college debt disaster, listen up.

Community college is astronomically more affordable than 4-year universities. By working a part-time job, you can pay off most if not ALL of your tuition. My parents were able to help pay my tuition, and this saved all of us a lot of money.

My first two years of college only cost around $5,000 TOTAL. Can’t beat that.

Not to mention the fact that I had fantastic instructors and could choose from a plethora of course offerings at a time when I had little idea what I wanted to do. Studying a little bit about each of my varied interests ultimately helped me determine my major.

Many people attend 4-year universities without knowing what they want to major in. Once they figure it out, they’ve already spent on average $45,000 on their first two years. They may even have to transfer to another college for the program that they want.

Do. Not. Do this.

The first two years of college are all prerequisite, general education courses that are (mostly) the same wherever you go. Take these classes at a community college and save yourself up to 90% off tuition costs.

This was the thriftiest thing I had ever done up until that point, and I didn’t even realize it.

Instead of wasting thousands of dollars per credit hour until you “find yourself”, spend just a couple hundred. You’ll save money and feel confident transferring to your (expensive) dream college.

2. Budget and cut expenses.

I’m notorious for setting goals and then not sticking with them. But using a simple budgeting method makes it easy to set and REACH my financial goals.

And, it doesn’t involve too much math. Yuck!

If I could tell you exactly how much I’ve saved by just simply logging and monitoring my expenses each month, I would. Just know that I wouldn’t have started investing in stocks or saving for retirement had I not…

And all credit belongs to my 11 step budgeting style.

When you start budgeting, the most important step is just to track your spending for at least 2 months.

You mean spend as I normally would? Okay!

The reason why you should do this is so that you figure out what comprises your normal monthly expenses. Tracking this for 2 or 3 months allows you to see averages. For example, your average monthly Starbucks expenses, or the average cost of groceries per month.

Averages are the key. Don’t beat yourself up because your car needed new tires this month, or your friend had a wedding and you bought them a badass wedding gift.

You need to figure out where your money typically goes before you try to cut back.

Once you’ve figured out where, you need to decide what to cut back on. And at this stage, it is really important that you are realistic. Don’t say that you’re never going to have a Starbucks latte for an entire month. Just like dieting, don’t set yourself up for failure.

Don’t go cold-turkey on the things that you enjoy.

When eyeing up your monthly expenses, you should be thinking: reduce but don’t eliminate.

Where can you reduce costs? What things do you need, not just want?

By rephrasing it in your mind, it becomes far more achievable and a lot less scary.

Once you start reducing your monthly expenses, you’ll be surprised at how much you can save without changing your salary.

Related Read: 11 Hacks to Get Free Starbucks Drinks

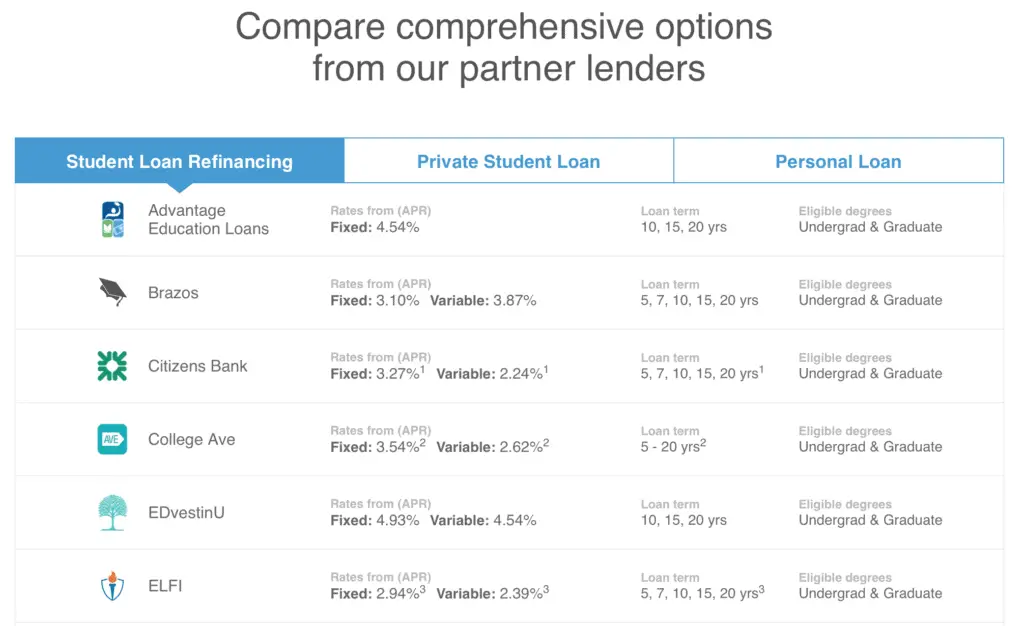

3. Refinance your loans.

After I graduated college, I considered refinancing but quickly felt overwhelmed. I was not a math or finance major, so how could I possibly figure this out? It seemed like an insurmountable task and one that would require this introvert to talk on the phone to strangers. Ugh, no thanks!

But nowadays, refinancing your loans is easier than ever.

Before you get started, you need to determine what types of loans and what loan amounts you have. Some are private, offered through companies like Citibank, Discover, Sallie Mae, etc. Others will be federal loans offered by the federal government.

Write down all of your loan information in one place.

Now that you have this information, let’s talk about options to refinance each.

For federal loans, the federal government does not offer students a way to refinance them (grrr…). What they do offer is consolidation of your federal loans.

Consolidating basically means your loans are merged together so that you make ONE monthly payment instead of one for EACH loan. This isn’t as good as refinancing because you still pay high interest rates, but it will help you tackle your debt more easily. You’ll receive one monthly bill instead of multiple from your various federal loan companies. Who wants more bills?

Private loans, on the other hand, CAN be refinanced and nowadays there are MANY companies that can help you do this.

Compare refinancing options using:

Credible

I cannot speak highly enough about Credible. They are one of the leading student loan refinancing companies and I highly recommend them.

Using Credible, you can easily compare lenders and interest rates so that you get the best rate possible. Doing so, can save you a lot of money (understatement of the year…).

They have an incredibly user friendly website and you can prequalify today.

Better yet, it’s completely free to apply!

FACT: The sooner you refinance, the more money you’ll save.

Some important things to remember about refinancing private loans…

1. It will affect your credit.

When you’re applying to refinance, your credit will be tapped briefly to verify interest rate offers, etc. The prequalified offers this generates will not affect your credit.

However, once you decide on a lender and refinance with them, this will impact your credit score. If your credit is good, no worries. But if your credit score is not great and you don’t want to impact it, take this into consideration.

2. Introverts, you’re safe.

This very simple process can be done completely online. Everything is just a few clicks and forms away.

So no lengthy phone calls with strangers. Yessss!

3. You’re taking out another loan, to pay off your current loan.

This is something I did not completely understand at first. But part of the reason why refinancing is so simple, is because you’re simply applying for another loan. You just fill out your information, upload some documents, and wait for approval.

Once you’ve been given the loan amount, you chuck it at that high-interest old loan (Avada Kedavra!).

Boom. Gone.

4. Interest accrues daily on your old loan.

Buuuuut not so fast.

While you’re going through the refinancing process, interest is accruing daily on your old loan. The beast keeps growing while you sharpen your sword…

Once you receive your new, lower interest loan, make sure you pay off the FULL amount of your old loan. Double check. Triple check. Quadruple check?

Most likely after you submit your pay off amount, you will have a couple of dollars leftover from daily interest that accrued on your account. Don’t forget to pay this down to zero!

5. Refinancing is free.

Say, whaaat?

Yes, it’s completely, 100% free.

You’re just simply paying off one higher-interest loan, to pay a lower interest rate on the same amount. So, why not save yourself hundreds if not thousands of dollars in interest?

4. Attack high-interest debt first.

A good rule of thumb is that: If you have high-interest debt (interest rates equal to or over 6%), then you need to tackle that first. If your debt is low-interest (below 6%), then you should start saving money and invest it.

I think this is a pretty good rule to follow. I threw all of my savings at my higher-interest loans, and then threw it at my lower-interest loans.

Get rid of your high-interest debt first. It is costing you more money by the day. So whatever you’re saving is being negated.

Related Read: 13 Mistakes That Are Keeping You in DEBT

5. Make your payments a nice, round number.

Let’s say your minimum monthly payment is $117.57. Don’t ever pay that.

What I mean is don’t pay the exact minimum, go above and beyond as much as you can afford.

A little trick is to round the number up, always. Instead pay $120 or $130.

Even if it’s just a little bit more than your minimum payment, you’re eating away at the principal balance and saving yourself some money in interest.

6. Move abroad.

Not a strategy typically recommended on personal finance sites, but one that aided me tremendously.

Moving out of America got me out of the rat-race. I left a life of needing to buy the latest products, going on 2 am Amazon shopping sprees, and spending too much money at Target (how I love you!).

Away from all this, I made wiser decisions about money. I spent on travel and experiences rather than things; I became a minimalist who was suddenly more mindful when deciding on new purchases.

This sounds so simple, because it is.

Leaving America changed my entire perspective about my actual needs and wants.

If you’re looking for a bit of an adventure and wanting to increase your ability to travel, overseas job opportunities are something you should consider. They often pay you nicely and you can live in a country with a much lower cost of living, saving you thousands of dollars each year.

Related Read: How to Live Frugally on ONE Income – 27 Clever Ways

7. Research balance transfer options on your credit cards.

It sounds terrifying, but hear me out…

This was a piece of financial advice I received from a financial advisor. I would not have paid off some of my smaller loan amounts had I not listened.

The idea behind this method is to first see what balance transfer offers you have on your credit cards. Often, your credit card company will give you the option to receive a deposit directly into your bank account. Think of it like a loan.

There will be a one time balance transfer fee but (depending on your credit) this is often lower than your higher interest rate loans. I received a one time 4% fee that helped me pay off a 7.5% interest rate loan. Yikes!

Not only did I save money on interest, but this also motivated me to pay off the loan. It essentially gave me a deadline. Balance transfer offers will typically give you 0% interest for a year, 18 months, or 2 years! Therefore I could not dilly-dally and pay just the minimum when I felt like it.

Also, there’s nothing more rewarding than seeing exactly how much you owe without daily interest accruing on it. You’ve paid a lower interest rate up front, so now all you see is that pesky number going down.

Conclusion

So, time for a quick recap…

Through a mix-n-match combination of:

- Attending community college

- Using a budgeting app to cut expenses

- Refinancing student loans for a lower interest rate

- Attacking high-interest debt first

- Making your payments more than the minimum

- Moving abroad

- Researching balance transfer options

..I was able to get out from under my soul-sucking student loan debt.

I was able to start spending my money on experiences. As a result I’ve been lucky enough to travel to 23 (and counting!) countries.

Everyone’s financial situation is different. Whether you’re just starting a budget for the first time, or working hard on reducing your grocery bill so you can save more each month, we can all make moves today that’ll inch us closer to financial freedom.

What’s been your journey?

Have you moved overseas or considered moving abroad to help increase your income and savings?

What strategies have you used, or are using, to gain financial independence?

Leave a comment below. 🙂

7 Tips to Pay Off Your Student Loan Debt

Here are more articles about getting out of debt:

For more ways to save money, check out these articles:

- 21 Extreme Frugality Tips That’ll Save You $1000s

- Amazon Direct Ship Ultimate Guide: Get FREE Stuff Delivered to You

- How to Do a No-Spend Challenge and CRUSH Your Money Goals

- Rainy Day vs Emergency Fund: What’s the Difference and Why You Need Both!

- How to Save Money on Hobbies (Without Giving Them Up)

- Gross Pay vs Net Pay: How to BUDGET the Right Way