Gross Pay vs Net Pay: How to Budget Your Income The Right Way

This post may contain affiliate links. If you decide to purchase through my links, I may earn a small commission. Read my disclosure page for more info.

You’ve just received your paycheck. Woot!

You’re chanting to yourself: “Show me the money!”

When suddenly…

You see the smaller of two numbers and realize:

THAT is what you’re actually taking home.

So which is it: your gross pay or net pay?

Understanding the difference between the two will either set you up for budgeting success…or failure.

So today, let’s first take a look at gross pay vs net pay and go over some easy-to-remember definitions.

Then, equipped with this knowledge, I’ll show you how to rock your budget each and every month.

What’s the difference between gross pay vs net pay?

Being able to distinguish between gross income and net income is extremely important for budgeting purposes and filing your taxes.

Also, if you have a nice side-hustle that earns you extra money, it is vital that you understand where and how to factor in that income.

Check out my 15 Online Side Hustles for Introverts for some extra income ideas!

So without over-complicating things, here are two simple definitions of gross income and net income to get us started:

Gross Pay or Gross Income Definition

Gross pay or gross income is the amount that you are paid either hourly or annually in the form of a salary. Gross pay is your income before taxes and deductions are taken out.

When you receive your paycheck, you’ll often find your gross income listed above your net pay.

As well, if your side-hustle earns you an extra $200 before taxes, that should be added to your gross pay.

Net Pay or Net Income Definition

Net pay or net income is the amount of money you take home after taxes and deductions are taken out.

Your net pay is often placed at the bottom of your paycheck, and that is the amount you actually receive.

If your side-hustle is in the form of a contracted part-time job, chances are that employer is paying you a net pay after taxes. Therefore, add your side-hustle income to your primary job’s net salary or net pay.

How do I calculate my gross pay ?

If you’re a salaried employee, first take a look at your employment contract. This will show your annual gross salary.

You don’t need to calculate anything, unless you have additional before-tax income from side-hustles or part-time jobs.

But if you can’t locate your contract, here’s how you can calculate your gross pay from your latest paycheck:

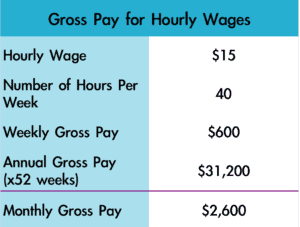

Gross Pay for Hourly Wages

If you are paid by the hour and work a set number of hours per week, then calculating your monthly or annual gross pay is quite simple.

Let’s say Mary gets paid $15/hour as her gross hourly wage. She can simply multiply that by the number of hours she works each week, month, and then year to determine her gross pay.

Here’s what Mary’s calculations will look like:

Gross Pay for Salaried Job

The easiest way to calculate your gross pay is to look at your pay statements.

If you’re paid monthly, simply multiply your monthly gross income by 12.

For example, if you’re paid $4,000 per month then your annual gross income would be $48,000.

If you’re paid every two weeks, then multiply your bimonthly gross pay by 26 (52 weeks/year divided by 2). So if you receive $1800 every two weeks, your annual gross income would be $46,800.

How do I calculate my net pay?

Knowing your gross pay is all well and good, but ultimately the most important number is the amount of money you take home—your net pay.

If you have access to your latest pay statement, I’d recommend determining your monthly net pay by multiplying your bi-weekly or weekly net pay by either 2 or 4 respectively. This is a much faster way of determining how much you take home every month roughly.

Calculating your net pay without a recent paycheck can be quite tricky. However, at the very least you can calculate estimates of your monthly net pay for budgeting purposes.

Here’s a 3-step process to figure out how much money you actually make:

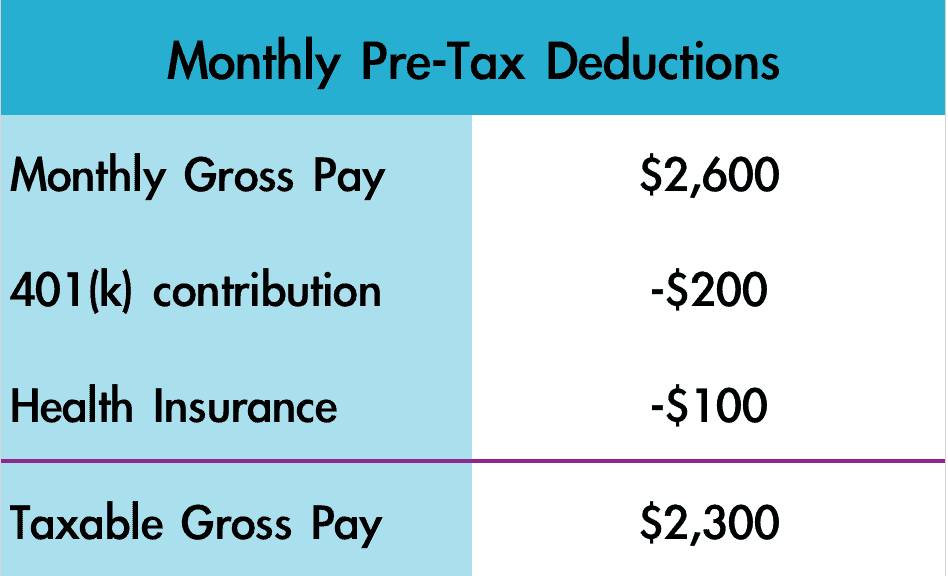

1. Calculate your pre-tax deductions

Pre-tax deductions are voluntary and aren’t required by law. These will be benefits that you have opted into from your employer’s benefits package, and they are taken out of your gross salary before taxes.

Some examples of common pre-tax deductions include:

- Health insurance

- Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

- Dental insurance

- Retirement contributions, for example a 401(k) plan

- Commuter benefits

- Vision benefits

- Life insurance

You can find any pre-tax deductions and benefits listed on your latest pay statement.

Depending on whether you’re paid every two weeks or once a month, you should be able to calculate how much you pay into these benefits from your gross monthly income.

In my previous post, I recommend creating a monthly budget. Therefore, focus on calculating a monthly total of your pre-tax deductions.

After taking out Mary’s 401(k) and health insurance contributions, here’s her taxable gross income:

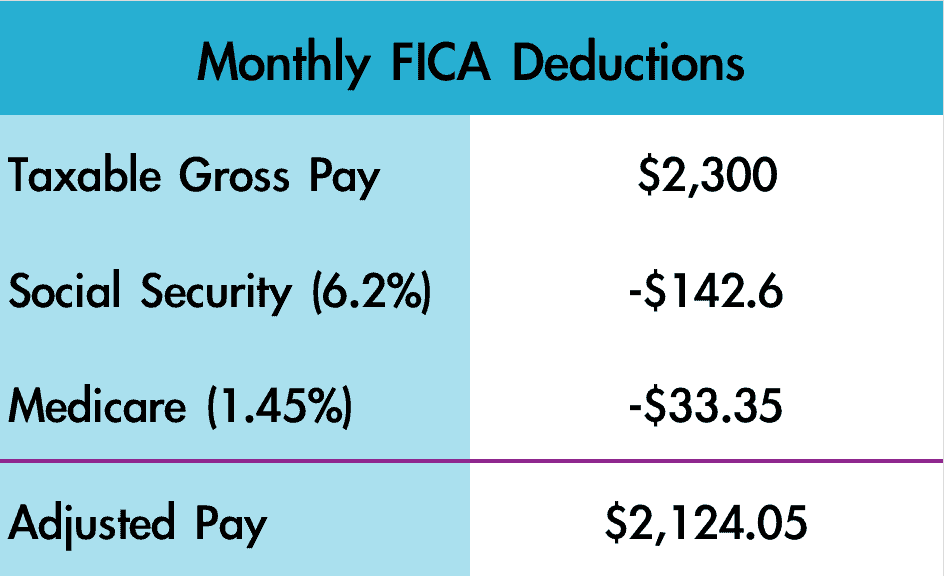

2. Subtract Federal Insurance Contribution Act (FICA) taxes

Next, we need to subtract taxes that are required by law, such as the Federal Insurance Contribution Act (FICA) tax.

FICA taxes include both Medicare and Social Security taxes.

Here are the rates for each as stipulated by the Internal Revenue Service (IRS):

- For earnings up to $137,700

- 6.2% Social Security tax

- 1.45% Medicare tax

- For self-employed people

- Must pay both the employer and employee FICA taxes

- 12.4% Social Security tax

- 2.9% Medicare tax

Here’s what Mary’s FICA taxes will be:

3. Subtract income taxes

A few different factors determine your income tax rate, such as your:

- Tax filing status (single, married filing separately, married filing jointly, or head of household)

- Gross income

- Pay schedule

- and the IRS’s current income tax withholding table

To keep things simple, and to not bore you, I’d recommend heading over to Smart Asset’s Federal Income Tax Calculator to do this for you. They also have state a handy Paycheck Calculator with which you can factor in state income taxes and pre-tax deductions.

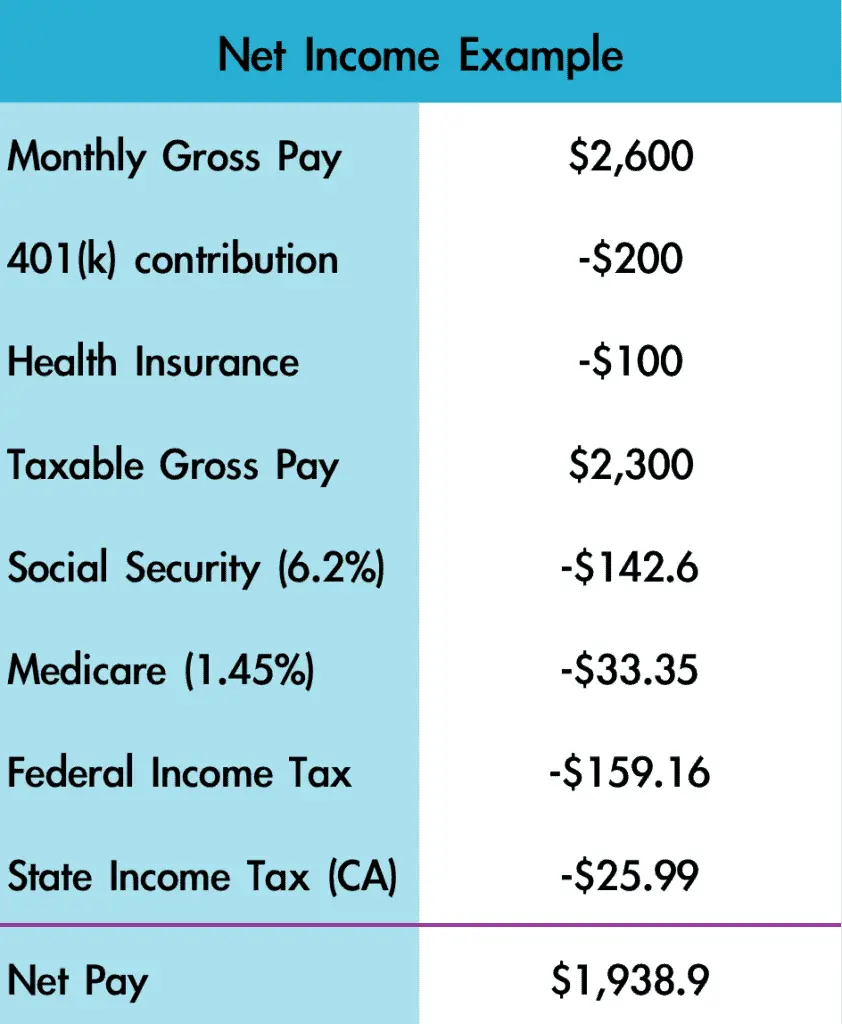

Net Income Example

Whew. We’ve come along way.

Sticking with our initial salary example, here’s a table showing Mary’s net income after pre-tax deductions, FICA tax, and Federal and State (California) income taxes:

Which do I use for budgeting: gross income or net income?

If you’ve read my post 11 Simple Steps to Create Budget, then you already know that I favor a monthly spending allowance budgeting method.

Why?

Because I like to do my calculations on payday and know exactly how much “spending allowance” I have leftover for my rainy day and emergency fund, retirement savings, and everyday purchases.

The monthly spending allowance method gives you more freedom in your financial planning. Your monthly spending allowance is yours!

From your allowance, you can:

- set up bespoke sinking funds (savings put towards specific purposes, like birthday/Christmas presents)

- put money towards debt

- determine a set amount for retirement savings

…and more! All while ensuring you cover fixed expenses like housing, utilities, insurance, and transportation costs.

Therefore, with this budgeting method, you should always base your monthly budget off of your net monthly income.

From there, you can calculate your monthly spending allowance using my 11 step system.

How do I ensure my net pay can cover all of my monthly expenses?

Through effective budgeting and frugal spending, your net income should be able to cover everything from your housing, utilities, transportation, insurance, food, entertainment, debt, and savings.

It IS possible to spend, save, and free yourself from financial worries.

Here are some of my biggest tips to make your income go even farther:

- Take a look at step #9 of my 11 step budgeting system to learn how to use your monthly spending allowance strategically to save and pay off debt.

- Track your spending from 2-3 months to determine what you can cut back on.

- Start living frugally by following some of my 75 Easy Frugal Living Tips.

- Download my 75 Frugal Hacks Cheatsheet to your phone, so you’re always thinking about ways to be more thrifty!

Related Read: 27 Frugal Habits to Thrive on ONE Income

For more ways to save money, check out these articles:

- 75 Easy Frugal Living Tips to Save Money Now!

- Amazon Direct Ship Ultimate Guide: Get FREE Stuff Delivered to You

- 11 Simple Steps to Create a Budget THAT WORKS!

- How to Do a No-Spend Challenge and CRUSH Your Money Goals

- Rainy Day vs Emergency Fund: What’s the Difference and Why You Need Both!

- How to Save Money on Hobbies (Without Giving Them Up)