How An Introvert Spending Money Is Different Than An Extrovert

This post may contain affiliate links. If you decide to purchase through my links, I may earn a small commission. Read my disclosure page for more info.

Think you’re 100% in control of your spending habits?

Think again.

Did you know that your personality type, whether you exhibit more introversion or extroversion, actually influences how you spend your money? It’s true!

While we already know that introverts make less money than extroverts, recent studies have shown that introverts and extroverts also spend money differently, show contrasting saving behavior, and approach purchasing decisions in different ways.

In general terms, introverts are individuals who recharge when they’re alone and expend energy during social interactions. Their thinking is primarily focused inward and concerned with their own thoughts, feelings, and actions.

Extroverts, on the other hand, thrive when socializing and are more talkative and outward-thinking. External factors, such as people and the surrounding environment, have a larger influence on their thoughts, feelings, and actions.

So then how is an introvert spending money any different to an extrovert spending money?

Let’s first answer what’s probably the biggest, most pressing question around this topic…

Do extroverts or introverts spend more money?

According to a 2014 study by the University of Toronto, extroverts save less money and therefore spend more money than introverts. The study revealed that one’s personality trait, specifically where they fell on the introversion/extroversion spectrum, greatly influenced their behavior around saving money.

Jacob B. Hirsch and his fellow researchers also looked at the impact of this on a broader scale. In the United States, for example, Hirsch found that states with higher rates of extroversion also exhibited less household saving behavior.

And even globally, countries with more extroverted populations also led to lower gross national savings.

So it’s clear that personality type has an impact on the spending and saving habits of individuals, households, and even nations.

Why do extroverts spend more money?

While the fact that extroverts spend more money than introverts is an interesting bit of knowledge to have, it’s even more important to understand why our personalities have such a large impact on our spending.

Because of their personality type, extroverts seek and value external rewards more than introverts. So when it comes to purchasing items, extroverts desire that instant gratification, which makes them more susceptible to impulsive spending.

Introverts, on the other hand, are known to be more careful decision-makers, as introverted thinking is often shifted inward and reflective. Therefore, introverts don’t experience as much personal satisfaction or dopamine-release in the brain from external rewards and, as a result, are less likely to impulse purchase.

What do extroverts spend money on?

Although it’s (obviously) impossible to round-up a list of things all extroverts spend money on, extroverts are more likely to spend money in particular ways due to the characteristics of their personality type.

Here are 4 things extroverts are more likely to spend money on:

1. Social engagements.

Being the social, outgoing type, extroverts are prone to spending more money on social events, such as meeting friends at the bar, attending parties, dining out, etc.

As it turns out, socializing more frequently often means spending more money, which has a negative impact on extroverts’ savings potential.

2. Impulse purchases.

As we looked at before, research has shown that extroverts value external rewards.

And what’s more rewarding than that pair of shoes you just have to have, or that fancy new iPhone that just came out?

Extroverts susceptibility to instant gratification makes it more challenging for them to avoid impulsive spending.

3. Luxury items and status goods.

Because external factors, such as the people around them, influence their thoughts and actions more, extroverts are more prone to that “keeping up with the Jones’s” mentality.

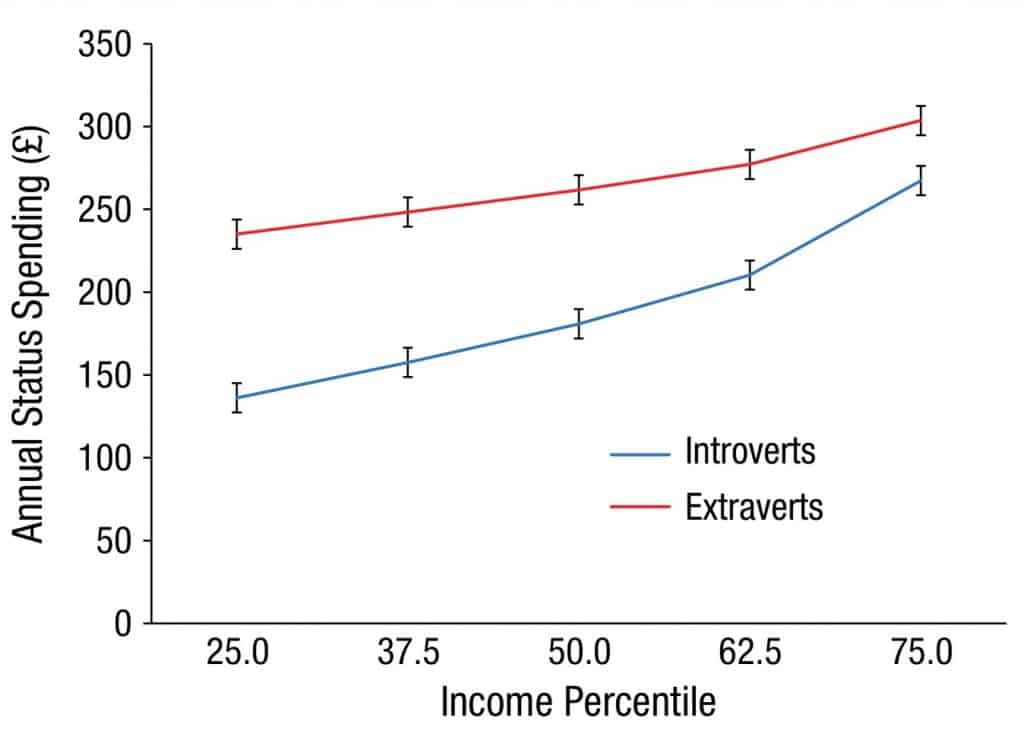

In a 2017 study done by University of London, researchers found that low-income extroverts spend more money on status goods, like expensive name-brands and luxury items, than low-income introverts.

Why might this be?

One reason discussed is that because extroverts have a “tendency towards sociability and ambition,” these factors also predict “how much people value status” (Blaine Landis and Joe J. Gladstone).

However, it’s important to note that as their level of income increases, the gap between introverts’ and extroverts’ spending on status goods narrows.

4. Brands with strong advertising.

Studies have shown that extroverts have a tendency to evaluate products and advertisements in more positive ways than introverts. As a result, these positive associations can lead extroverts to spend more on products they discover through ads and other marketing strategies.

Alternatively, introverts tend to evaluate product advertisements more negatively and even suspiciously. So when it comes to purchasing, introverts are in many cases the tougher sell. Brands and products must really speak to an introvert’s internal thoughts, feelings, and personal values.

What do introverts spend money on?

Once again, it’s difficult to lump all introvert spending into a single, all-encompassing list.

But it is a bit easier when you contrast introverts’ spending with that of extroverts.

So here are 3 things introverts spend less on:

1. Less on social engagements.

Unlike extroverts, introverts are easily drained by social gatherings, especially if they happen too often and involve large groups of people.

Because of this, introverts spend more time at home, which also means they spend less money at restaurants, bars, and all the modern-day “watering holes.”

2. Less on luxury items and status goods.

As discussed before, introverts spend less money on luxury items and products perceived to increase social status than extroverts.

This is because introverts are more internally motivated. They are less likely to seek friends who are superficial or judge others based on external factors, such as what they purchase and wear.

Rather, introverts value meaningful connections with other people, which are often more difficult to form. This leads to introverts having fewer friendships (in number) but ones built on deep, meaningful connections nonetheless.

3. Less on impulse purchases and short-term rewards.

Another characteristic of introverts is that they’re less motivated by external rewards and the resulting instant gratification. This means that introverts spend less impulsively and think more long-term about the purchases that they make.

So when deciding whether or not to buy that fancy new television, introverts will be more careful decision-makers, weighing both the short-term benefits and long-term financial effects of such a purchase.

Related Read: How to Save Money on Hobbies WITHOUT Giving Them Up!

How can introverts reduce their spending even more?

Although introverts have a leg-up in regards to spending less money, that doesn’t necessarily mean that we’re in the clear.

Whilst our personality type helps, it’s still important for us to take a hard look at our lifestyle, financial situation, and spending habits so that we can achieve our financial goals and maximize our personal happiness.

Here are 4 ways both introverts and extroverts can reduce spending and move closer towards financial freedom:

1. Adopt a frugal living lifestyle.

The best way to spend less money and save more is by embracing a more frugal lifestyle.

I know changing your lifestyle sounds intimidating, or perhaps even impossible, but it really shouldn’t! There are so many small ways to live frugally and save every day that can quickly become second-nature to you.

And even more extreme frugal living habits are becoming more and more mainstream.

But perhaps the greatest benefit to frugal living is that it not only boosts your savings but helps to reduce your impact on the environment. A lot of frugal living tips will actually reduce waste and lower your carbon footprint.

To kickstart your frugal lifestyle, snag my 75 frugal hacks cheatsheet so you can change your spending no matter where you are.

Related Read: 55 Clever Products That’ll Save You Money in the Long Run

2. Budget your money, and stick to it.

Budgeting isn’t the sexiest, I get it.

But planning out your finances in order to meet both your short and long-term money goals is crucial to becoming financially stable.

And financially stability means:

- No more worrying about money.

- Having a rainy day and emergency fund to fall back on.

- Getting out of debt.

- Retiring comfortably, or even early.

So maybe budgeting isn’t sexy, but the benefits sure are!

To find out how you can create a budget and stick to it, check out my simple 11 step budgeting guide.

3. Challenge yourself to not spend.

It sounds absolutely insane, but:

You can go one day, three days, a week, even a month without spending money.

While you can’t necessarily stop spending on fixed expenses like housing, utilities, health insurance, transportation, etc., almost all other spending is within your control. You can significantly reduce other expense categories or completely eliminate them.

So how do you control your spending and sniff out the excess?

With a no-spend challenge!

In short, no-spend challenges are when you commit to not spending any money at all, or on certain items, for a pre-determined period of time.

Challenging yourself to not spend money is one of the best ways to save money and also reassess your relationship with money. A lot of times we form spending habits that are detrimental to our financial well-being (like eating out too frequently and not meal-planning).

No-spend challenges are easy to start when you approach them with clear goals and a plan. Read my in-depth guide to no-spend challenges, so you too can save more and start to think more frugally!

4. Take advantage of EASY ways to save money.

If you bring your smartphone to the grocery store or regularly shop online, then you have to take advantage of all the simple, easy-to-use services that’ll save you hundreds of dollars a year.

They’re 100% FREE to use and only require you to download an app or browser extension. That’s it.

Check out my 3 favorite ways to save money on groceries and everyday purchases, so you can cut your spending and save BIG:

- Ibotta lets you earn cash back and gift cards by shopping both in-store and online at your favorite retailers. If you’re shopping in-store, you can pay using the Ibotta app to earn instant cash back on your purchase. Or, if you pay using a different method, you can scan your receipt to get cash back too! Sign up today to get a welcome bonus of $20!

- Rakuten (formerly Ebates) lets you shop online or in-store and get free gift cards or up to 40% cash back at over 2,500 stores. You simply download the app onto your phone or use the browser extension on your computer while you shop. For signing up with Rakuten today, you can get a nice $10 instant bonus!

- Swagbucks is another cash back program that pays in gift cards as well. You earn by doing your normal online shopping, taking surveys, watching videos, playing games, and simply searching the web. Sign up today and you’ll receive an INSTANT $10 bonus!

Can money actually buy happiness?

So if extroverts and introverts are spending money on different things and in different ways, then is this spending actually making each personality type happier?

Well, as it turns out:

Yes, money can buy happiness, but it depends…

Studies have shown that spending money can actually make us happier if our purchases align with our personality.

So if you’re an extrovert who loves frequenting your local pub to hang with friends, then that’s something worth spending on.

Or, if you’re an introvert who spends a lot on hobbies, or can’t say no to that killer Etsy find, then that’s okay too!

What’s most important is that you’re budgeting your income, reaching your financial goals, and cutting expenses where you can, whilst still spending money on the items and experiences that make you happy.

Because otherwise, let’s face it:

Life would be pretty dull, right? 🙂

Introvert Spending Money vs. Extrovert Spending Habits

Want to reduce your spending? Check out these other save money articles:

- No-Spend Challenges: Ultimate Guide to CRUSHING Your Money Goals!

- 21 Extreme Frugal Living Tips That’ll Save You THOUSANDS

- 74 Easy Frugal Hacks with a BIG Impact

- 11 Hacks to Get FREE Starbucks Drinks!

- How to SAVE MONEY on HOBBIES, No Matter What They Are!