75 Easy Frugal Living Tips with a BIG Impact (Save $1000s!)

This post may contain affiliate links. If you decide to purchase through my links, I may earn a small commission. Read my disclosure page for more info.

Are you counting down the days until payday?

If you’re like most people, by the time payday rolls around your bank account is looking pretty depressing.

Fortunately, in addition to creating the perfect budget, there are tiny actions you can take each day to start saving money–no more dried up checking account!

I know what you’re thinking:

Can small changes really make a significant impact on my savings?

Well, it all boils down to this simple fact:

The little things really do add up.

I remember when I first realized the truth of this statement. I was 16 years old and saving for my first trip to the UK. And my job at the time—well, it paid a measly $7/hour.

I felt like I was setting myself up for failure. How could I possibly save enough money on such a small income?

That’s when I realized that I had to take a hard look at how I was spending my money. It wasn’t easy, but eventually I was able to figure out tiny ways to live more frugally.

And in the end?

Those tiny changes in spending habits enabled me to take that trip to the UK. And much later, they also helped me pay off over $55,000 in student loan debt.

So today, I’d like to share with you some of the ways I’ve been saving money from the time I was 16 until now.

Here are 75 simple frugal living tips with a BIG Impact, so you can cut expenses and save money–no matter what your income is!

But wait!

Get my super convenient cheat sheet of these same 75 frugal living tips delivered straight to your inbox! Save it to your phone for a nice, handy reminder that you CAN save money and reach your financial goals!

75 Best Frugal Living Tips With a BIG Impact

Food and Shopping Frugal Living Tips

1. Make a Meal Plan

Making a weekly meal plan is one of the best frugal living tips with a big impact.

Every week, my boyfriend and I sit down and think about what meals we’d like for the week. From this, we make a grocery list of only the things we need to make those delicious, home-cooked meals.

If you consider the cost of take-away, restaurant food, and all the items that would’ve slipped into our shopping cart if we didn’t have a meal-plan…then you can start to see the financial benefits of meal-planning.

I wish I could tell you exactly how much money we save with this one frugal living tip, but needless to say it is A LOT.

Meal-plans help you eat healthier, save you money, and ensure that you have all the ingredients to cook yummy meals at home.

Related Read: How to Meal Plan Like a PRO (Save $200+ a Month!)

2. Make a Grocery List

…and stick to it.

If you wander around the aisles of the grocery store aimlessly, you’ll inevitably end up buying more than you need.

So before you venture out, make a grocery list. If you want to be super organized about it, categorize the items by the grocery section they are located in.

Now when you arrive, you can go section by section and grab the items on your list. You will be far less tempted to pick up extra items this way!

Related Read: 55+ Cheap Foods to Buy to Save Money (+ FREE Grocery List!)

3. Limit Trips to the Grocery Store

Try to only go grocery shopping once per week.

The more times you are physically in the grocery store, the higher likelihood that you’ll buy things you don’t need and spend more money.

Stick to your grocery list, weekly meal plan, and stay out of the store. These 3 frugal living tips will save you a ton of money!

4. Pay Attention to Unit Prices

Unit prices on products basically tell you how much of something you’re getting and for what price.

Depending on which state you are in, unit prices may or may not be displayed. If they are, don’t always trust them.

The surest way to get more for the money, is to calculate it yourself.

Take the price of the product and divide it by the number of liters, pounds, ounces, etc.

5. Buy in Bulk

I am the queen of bulk purchasing.

I remember when I first stepped into a Costco, it felt like I’d entered heaven.

After meal-planning for a few weeks, you’ll probably discover dry goods that you purchase often.

These are the things you should buy in bulk.

It’ll feel like you’re spending more money now, but over time you will be saving a lot.

Other things you should buy in bulk are household goods like: toilet paper, paper towels, shampoo/conditioner, soap/body wash, cleaning products, hand soap, feminine hygiene products, laundry detergent, etc.

Basically, all the necessities with a long shelf-life, you should buy in bulk.

6. Keep Your Fridge Organized

If your refrigerator is a complete mess, then you probably have no idea what’s in it.

Go through your fridge and organize it.

This way, you’ll be able to see what you have and what meals you can make for the week.

Also, you will only buy the things you need at the grocery store.

7. Keep Your Pantry Stocked with Essentials

Your pantry should always be stocked with herbs, spices, and dried seasonings that can be used in a variety of recipes.

The idea behind this is simple. When you discover recipes you’d like to try, you won’t have to purchase every single little ingredient to make the dish work.

Some recipes include random, and at times expensive, ingredients that you could easily substitute and still make a delicious meal.

This also means that you’ll have ingredients that you love ready to go for meals you cook frequently.

Related Read: 55 Clever Products That’ll Save You Money in the Long Run

8. Eat Through Your Home

With your fridge organized, and your pantry stocked with essentials, you should be eating through ALL of the food in your house each week.

This is because your weekly meal-plan and weekly grocery shopping should be just that: a week’s supply of food.

If you leave stuff in your fridge and don’t eat it, most likely it’ll end up going to waste. And that’s wasting money.

9. Cook at Home

According to the U.S. Bureau of Labor Statistics, millennials are the biggest spenders on food away from home.

It’s clear: we like our brunches and all that greasy bar food.

But we’re also wasting a lot of money that we could be saving.

Whether it’s lunches at work, or evening meals out, the average American household spends over $3000 a year.

That’s $3000 you could’ve invested and saved by cooking your meals at home.

10. Prep Your Meals

For this frugal living tip, choose one day every week (I personally like Sundays) and use this time to prep your breakfasts and lunches for the week.

Some of my favorite meals/snacks to prep include: homemade granola and/or muesli, overnight oats, hardboiled eggs, quinoia, and chicken breasts for salads or fajitas.

There are loads of recipes online for meal-prep days. Take a look and see which ones work for you!

11. Cook in Bulk

Cook meals that you can cook in bulk.

Think: soups, chilis, curries, and stews.

Make a nice big batch of these and you’ll have lunches and dinners ready to heat up and eat.

12. Use your FREEZER!

Those meals you’ve prepped? Those soups you’ve made?

Put them in the freezer!

Guys, when you have time to cook (like on weekends, for example), make the most of it. Cook meals that you can pop in the freezer and save for a later date.

This will save you a ton of money during the work week when you’re even more tempted to just get food delivered or order take-away.

13. Carry Snacks with You

Have you ever been driving home from work, hangry, and feeling like dinner can’t come soon enough?

I know I have. So inevitably I’d end up stopping at a gas station or going through a drive thru to pick up a bite to eat.

These moments of hunger between meals can drain your wallet over time.

Instead, always bring a ziplock bag of nuts, crackers, dried fruit, granola, or whatever your favorite pantry item is.

You’ll save money and eat healthier. It’s a win-win.

14. Make Granola or Muesli at Home

I will probably write an in-depth post about this later because I loooooove granola and muesli.

And it is soooo much cheaper to make yourself.

It’s the perfect handy snack to carry with you throughout your day, and it’s packed with protein to keep you feeling full.

If you stop those pesky cravings with granola/muesli, your waistline and wallet will love you.

15. Drink More Water

Trade those expensive cans of soda and fruit juices for water.

Not only is water what your body actually wants/needs, but just by simply drinking water everyday you save money.

Now, some American cities are implementing a soda tax as well, raising the costs of this bad habit even more.

So give up the sugary drinks. They cost to drink them and they aren’t good for your body.

16. Carry a Water Bottle

Now that you’re drinking water instead of soda and juice, you should start carrying a water bottle with you everywhere.

You can refill your bottle at almost all restaurants and avoid buying the pricey bottled waters.

It’s important to invest in a quality water bottle, one that keeps your water a the temperature you like and is BPA-free. Because, who wants to be drinking harmful plastic chemicals?

I recommend either the Hydro Flask or Hydro Cell bottle which comes with a straw.

You’re saving yourself money and the planet.

17. Make Your Own Coffee

Starbucks, how I love you.

But Starbucks, how my wallet hates you.

If you’re like me, you can’t remember the last time you went a day without coffee. (I’m not endorsing this addiction, but my love for coffee is real guys.)

But that morning brew doesn’t have to break the bank.

Before you leave for work, use your French Press and pour that morning coffee into your thermos.

It takes 10 minutes tops to save at least $3+ everyday.

Related Read: 11 Hacks to Get FREE Starbucks Drinks

18. Eat Less Meat

Meat ain’t cheap.

Try to reduce the amount of meat you purchase at the grocery store. Instead, buy more fruits, vegetables, and grains to supplement.

Another idea, is to participate in events like Veganuary and see how much money you might be able to save by reducing or even eliminating your meat consumption.

19. Eat Less

This frugal living tip will have a big impact on your savings AND waistline!

According to Business Insider, the average American consumes more than 3,600 calories per day.

Compare this with the average recommended calorie consumption of 2,500 for males and 2,000 for females.

Now obviously you need to take into consideration your daily exercise routine and how many calories allow you to maintain a healthy weight.

But once you figure this out, those extra calories are ones your body simply doesn’t need. And those are dollars you don’t need to spend.

20. Eat Out Less

Restaurant food is delicious…but expensive.

It’s hard to say no to a brunch invitation from a friend, and I’m not saying you have to.

Just keep track of exactly how much you’re spending at restaurants. Create a budget and make sure you’re balancing eating out with friends and still working towards your financial goals. There are bound to be ways you can cut back on the number of times you go out and what you consume.

21. Get Food To-Go / Take Away

If you do go out to eat, take some of that food to-go!

After living outside of America for a while now, every time I return I’m reminded of how ENORMOUS portion sizes are in the States.

These aren’t the normal-sized meals your mother used to make. You don’t need to “finish your plate” before leaving the table.

Instead, think about splitting the price of that meal over 2 meals. Get some of it to-go and give yourself a nice lunch the next day. It makes that expenditure go a little bit further.

Frugal Living Tips for Hobbies and Entertainment

Don’t give up the things you love just for the sake of saving money.

Hobbies are incredibly important and necessary for all of us. If you need to cut back on these a bit, check out my post all about ways to save money on hobbies.

That being said, here are frugal living tips that’ll allow you to pursue your interests and still save money.

22. Get Rid of Cable TV

The #1 frugal living tip with a big impact (possibly the BIGGEST): Cut the cord.

Cable and satellite companies are making a killing, and your wallet is suffering.

According to BankRate.com, these companies “have seen their average revenue per user increase 53 percent since 2007 to $100.96 in 2017.”

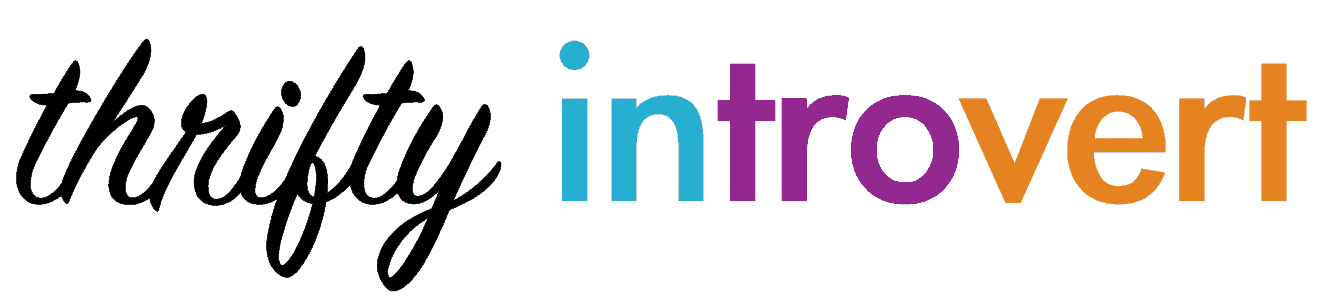

If you’re spending between $60-$100 a month on cable television, investigate what streaming options you have that would still allow you to watch the things you actually watch.

Nowadays, services like YouTube TV, Hulu with Live TV, and Sling TV can give you access to your favorite live channels streamed right over the internet.

To get started, you’ll need a smart TV or streaming device such as an Apple TV, Roku, or Amazon Fire TV stick. (I’m all about Apple, but I’ll save that for another post.)

23. Reduce Your Subscriptions

Now, the inverse of paying way too much for cable TV is paying for too many monthly subscriptions.

When budgeting, it’s important to write down every subscription service you pay for—whether it’s news, movies/TV, music, etc.. You may be surprised at the cost of these when you add them all together.

For one month, track how frequently you use each one. Chances are, there are some that you aren’t utilizing enough to justify the costs.

Also if you are struggling to eliminate some, think about family members you might be able to split these subscription costs with.

24. Buy Digital Instead of Physical

For most hobbies, whether it’s video games, music, books, movies, and TV shows, buying digital subscriptions instead of physical products can have a big impact on your savings.

For the gamers out there, services like Playstation Now ($59/year or $9.99/mo) and Xbox Game Pass ($119/year or $14.99/mo) offer monthly or annual memberships that give you access to a massive library of games and featured ones each month.

Compare this to the average price of ONE physical game, which is anywhere between $20-$60.

Music lovers out there should already be using services like Apple Music, Spotify, or Amazon Prime to satisfy their diverse musical tastes instead of buying CDs and records.

Readers should pick up a Kindle and consider whether to buy ebooks individually or sign-up for the Kindle Unlimited plan. Again, determine if this subscription is right for you based on how many books you burn through in a month.

And lastly, for the hobbiers like me who consider movies and TV shows their true passion, sign up for subscription services (Netflix, Hulu, HBO Now, Amazon Prime, and Apple TV+).

It’s undeniable. Buying digital instead of physical helps you keep a minimalist home and be a more frugal spender when you factor in the amount you consume.

Related Read: 13 Legit Ways to Get FREE Steam Codes

25. Get Free Ebooks

After you buy your Kindle, check out the thousands of free ebooks available at Amazon.com.

There are loads of classics available and downloading free ebooks before purchasing others can help you stick to your budget.

26. Sell Your Stuff

Declutter guys!

Some of us tend to be collectors as well. It comes with all that intense hobby-ing we do.

But, we don’t have to be hoarders!

Go through your stuff and see what holds personal value and what you’re just “keeping around.” You’ll probably find some items that don’t serve much purpose anymore.

Sell these items on sites like Craigslist, Ebay, Facebook Groups related to your niche, or resale stores for books, games, etc.

27. Use the Resale / Trade Market

This is similar to the last frugal living tip. However, don’t just sell your stuff on these sites, also investigate what options you have to trade your items.

Stating the obvious here, but trading means you are saving money on the cost of items that you want.

For example, join a Facebook Group centered around board games and see if someone is willing to take yours and give you new ones that you haven’t played.

Again, great places to find good trades are Facebook Groups, Craigslist and other niche websites.

28. Buy Secondhand

Buy used where you can.

Not only are you helping to recycle, but you’re saving money.

Check out Ebay, Amazon sellers, Facebook Groups, and Craigslist for secondhand items to do with your hobby.

Also, Amazon sellers offer used video games, board games, books…you name it.

29. Join a Hobby Club

Get out there and find some like-minded hobbiers! (Small groups, preferably…)

Hobby clubs allow you to connect with people who are interested in the same thing and also open up opportunities to trade items and share resources.

If you join a book club, you can borrow books from people in your club. If you’re into board games, rotate games between members.

This frugal living tip will help you hobby on and not break your budget.

30. Budget for Your Hobbies

Speaking of which, make sure to include your hobbies in your budget.

This is where a lot of us go wrong.

Sure, we save a ton of money by not going out to eat as much, or skipping the shopping sprees. But, we tend to allow ourselves to make expensive or too-frequent purchases related to our hobbies.

I used to make budgets and stick to them when it came to groceries and living expenses…Pff, that’s easy!

But then, I’d often go over budget by purchasing too many books, cinema tickets, and movie subscription services.

This is okay, right?

Well, no.

We have to find ways to make our hobbies work within our budgets. We need to find a balance between following our passions and still achieving financial independence.

So while developing your personal budget, take into consideration what you’re currently spending on hobbies and determine whether this comprises an appropriate amount of your monthly expenses.

And if you’re struggling to fit your hobbies into your budget, check out:

Related Read: Simple Ways to Save Money on Your Hobbies

Tips to Save Money on Clothes

31. Clean Out That Closet!

Chances are, your closet is overflowing.

Probably because you have one or two clothing items that you just absolutely love to buy.

For me, it’s coats and shoes. I feel like I need a coat for every occasion and weather forecast, and boots of every height and every color.

But most of us never wear half the things in our closet.

Clean it out! Sell or donate the items you don’t use.

32. Buy Wardrobe Staples

For women, this frugal living tip will have a big impact on our savings, for sure!

Instead of buying every cute blouse you see on Modcloth (I know, it’s an obsession of mine too), stay focused on buying “wardrobe staples.”

Wardrobe staples include things like: a jean jacket, dark-wash jeans, a pair of oxfords, a black dress, ankle boots, black trousers, etc.

Obviously your wardrobe staples with vary depending on your style. But take a look at what you have now and which items you wear most often. These are your wardrobe staples.

Center your outfits around wardrobe staples and try to purchase any that you are missing. These items will give you more outfit combinations for the money.

33. Focus On Quality Not Quantity

When buying wardrobe staples, focus on quality not quantity.

Instead of buying a cheap pair of dark-wash jeans that you’ll need to replace in a month, buy a slightly more expensive pair that’ll last you longer.

I know, buying MORE expensive items doesn’t sound like one of the best frugal living tips…

However, this will save you a lot of money over time.

For example, instead of replacing that cheap pair of $20 jeans every 2 months because the quality isn’t great, buy a $50 pair that’ll last you a year!

Better yet, focusing on quality over quantity means you’ll be on your way to a minimalist wardrobe!

34. Make a Minimalist Wardrobe

If you have your quality wardrobe staples, great.

Now comes the difficult part though—get rid of stuff so that you only have a handful of quality items and some less-expensive clothes that match.

Aim to make a mix-n-match wardrobe within your favorite color palette. Pastels and lighter combinations are often suggested, but I personally prefer darker colors with punchy patterns mixed in.

Find what works for you, but try to have all of the items in your closet work together.

35. Shop at Thrift Stores

Your local thrift store has some great finds.

From wardrobe staples that have stood the test of time, to genuinely unique items, thrift stores are a treasure trove of inexpensive clothes.

If you’re looking for a new item to add to your minimalist wardrobe, stop at the thrift store before going to a department store.

You’ll start to put together a distinctive wardrobe that fits your personality and style.

36. Repair Don’t Replace

Before you throw out your favorite sweater because it has a hole in it, or that pair of oxfords with the soles falling off, think about how you might be able to repair these things before you throw down money on new ones.

Learn how to sew that button back on or patch up that hole in the armpit! This frugal living tip alone will save you the cost of replacing all these items.

If you just can’t be bothered, more than likely someone you know can help you out.

Alternatively, you can pay someone to do it (for example, shoe repairs).

37. Beware of Clothing Sales

Everyone likes a good sale. When you step into a clothing store, it’s hard to resist the giant signs screaming the discounts you will receive.

But beware!

Clothing sales often mean purchasing things you don’t need just because you’re “saving money” on them.

But getting that pair of jeans for $15 is a waste of money if you already have a perfectly decent pair at home.

Resist the urge to purchase things just because they’re on sale!

Frugal Living Tips for the Salon

38. Do Your Hair Yourself

Ladies, once again we get the short end of the stick here.

The cost of getting our hair done at a salon is outrageous.

Take a second to think about how much you spent on your last dye/highlight and cut…

The average price of a trip to the salon is $60-$100! And that doesn’t include tip!

Save the money. Do it yourself.

Related Read: 21 EXTREME Frugality Tips That’ll Save You $1000s!

39. Have a Friend Do Your Hair

If you don’t feel comfortable dyeing or cutting your hair, get a friend to do it.

40. Get Your Hair Done FEWER Times Per Year

If you’d just rather have a professional do you hair, then limit the number of times you go in a year.

I remember when I was getting my hair done 4 times per year and spending somewhere between $100-$150 each time. I look back on that and am horrified.

Now, I get it done maybe 2 times per year. I let my natural hair grow out and go for the occasional highlight.

Be honest about what you need to look and feel great. Find a way to work with your natural color if possible.

41. Shop Around for Good Prices

Don’t just go to a salon because it’s some fancy name-brand.

Shop around for the best prices and seek out recommendations from friends.

Frugal Living Tips for the Gym

42. Exercise at Home

The average cost of a gym membership is around $60 per month.

That right there is $720 you can save each year.

If you can’t part ways with your gym because it’s your hobby and you actually use it, then you are the exception.

But for most of us, we pay for a gym membership with all the best intentions…and then hardly ever go.

For the life of me, I could never make going to the gym a habit. It just isn’t one of my hobbies, and I can’t seem to make it one.

So if you’re sitting on a membership that you never use, get rid of it and keep the money.

There are fitness videos available on YouTube that can help you create a home workout routine.

43. Buy your own equipment

Invest your money in a good home gym.

Think about purchasing a fitness bike, elliptical, or treadmill instead of paying a gym to access this equipment.

For example, buy yourself a yoga mat, some hand weights, and an exercise ball.

Having a home gym, equipped with only the items you use, will save you a lot of money in the long run.

44. Run — It’s Free

If you live somewhere where space is tight and you don’t have room for exercise equipment, start running. It’s free!

Download apps like Couch to 5K to help you start building a habit.

45. Pay Monthly Don’t Pay Annually

It might be tempting to pay annually because it looks like the better deal, but be honest with yourself…

Are you actually going to use it regularly throughout the entire year?

If you haven’t had a membership before and are hoping to make going to the gym a new habit, pay monthly for a few months and see how you do first.

46. Get Your First Month Membership Free

Some gyms will offer the first month’s membership free. Or maybe you can find a Groupon deal that’ll let you try a gym out.

Use this free month to see how often you go and if you’d get your money’s worth by purchasing a membership plan.

Frugal Living Tips to Save Money on Pets

47. Groom Your Pets at Home

Frugal living tips don’t stop with the humans in your household!

Taking a dog or cat to the groomers can set you back around $40 and upwards of $100 for larger dog breeds!

Cut this cost by buying quality pet shampoo and bathing your pets at home.

Buy a grooming table for trimming your fur-baby, and you’re ready to go!

48. Rotate Dog Toys

As a dog owner, it seems like you have to constantly buy new toys to keep your canine entertained.

But in fact, this isn’t true!

Buy some toys for your dog but only allow him/her access to a few at a time.

Before these toys become completely destroyed by your aggressive chewer, rotate those out and bring the new ones in.

I always have dog toys on rotation so that Winston (our 8 month-old puppy) thinks he’s getting new stuff all the time.

Even when his old toys rotate back in, it’s like he’s discovering them for the first time. This frugal living tip saves me loads of money because, let’s face it, pet products ain’t cheap!

So save money and rotate those toys around. I promise, the pooch won’t notice.

49. Make Your Own Pet Treats

Treats for your pet can become very expensive over time.

But if you do one quick search on Google or Pinterest, there are loads of homemade treat recipes made from simple, everyday ingredients.

You will also feel comforted knowing exactly what your pet is eating. Some store-bought treats have an ingredients list that’s just way too long, and therefore raises questions around how healthy they truly are for your animal.

We like to use this dog treat recipe over at Pinch of Yum. They’re puppy-approved and easy to make.

50. Make Your Own Pet Food

For this frugal living tip, I suggest that you first consult with your veterinarian. Different pets have different digestive needs, health issues, and allergies.

But homemade pet food is really taking off. This is maybe a result of the number of recalls every year, as well as owners questioning why their pet food needs so many by-products.

Check out homemade pet food recipes and see what suits your pet and budget.

51. Buy Your Pet Meds Online

Heartworm preventatives, flea and tick medication, pain relief—whatever your pet needs, buy it online.

You will often find pet medications cheaper on websites like 1-800-PetMeds, PetCareRX, and Chewy Pharmacy.

52. Get Pet Insurance

Pet insurance is becoming increasingly popular these days. With veterinary bills costing owners thousands per year, paying $10 per month can save you money in the long run.

Compare prices and coverage on sites like Pet Insurance Review to make sure you’re getting what your pet needs.

Frugal Living Tips for Banking

53. Refinance Your Student Loans

Refinance your student loans through services like Credible.

If you have multiple federal and private loans spread out across different banking institutions, chances are you probably aren’t getting the best rate on all of them…or any of them.

Refinancing allows you to put all your loans together, pay a lower interest rate, and make one monthly payment.

Refinancing among other little frugal living tips, is what got me out from under over $55,000 in student loan debt.

Credible is one of the leading student loan refinancing companies and I highly recommend them.

Using Credible, you can easily compare lenders and interest rates so that you get the best rate possible. Doing so, can save you a lot of money (understatement of the year…).

They have an incredibly user friendly website and you can prequalify today without a hard credit check.

Better yet, it’s completely free to apply!

FACT: The sooner you refinance, the more money you’ll save.

54. Set Up An Automatic Savings Transfer

Most banks like Chase or Bank of America will give you the option to set up an automatic savings transfer. You choose the amount and the frequency.

This way, that money is automatically set aside for savings without you having to remember to deposit it.

I have opted for a transfer once per month, but you can set it up for every week or every day!

Your savings will grow without you even realizing it, and you’ll be working towards building your rainy day and emergency funds.

Bank of America’s Keep the Change program was one of the first to offer an automatic savings transfer. Keep the Change just rounds up each purchase to the nearest dollar and deposits the difference in your savings account.

Chase as well offers a program they call Autosave, which is very easy to set up.

Note: You’ll need to have a checking and savings account with whichever bank you choose to do this.

55. Sign Up for Cash Back or Rewards Credit Cards

There’s no doubt that signing up for a cash back / rewards credit card can be a thrifty thing to do.

If you’re going to spend money, why not make money while doing it?

I love reading The Points Guy for a quick glance at new credit cards and offers available.

However, the goal is still to pay off your credit cards each month, and in my opinion, avoid annual fees unless you can balance out that cost with rewards.

56. Don’t Pay Annual Fees on Credit Cards

Now, there’s a caveat to this one.

Some rewards credit cards charge annual fees and, depending on how you use it, you may be able to make up the cost of the fee with the rewards you earn.

But in general, I try to avoid annual fees on credit cards.

I try to keep my finances simple, which means I don’t like charging everything to a credit card just to play the points game.

But do some research and think about how you personally would use a credit card with an annual fee. Would it cover its own cost in rewards for you?

57. Avoid ATM Fees

ATM fees are killer, yo.

There’s nothing worse than paying a bank to give you your money, i.e. DO IT’S JOB.

So avoid giving mega-banks more of your money by sticking to your bank’s network.

OR…

Get a checking account with a bank that DOESN’T charge ATM fees.

Wait…whaaaaat? Those exist??

Yes, and the best one out there by far is Charles Schwab. I will forever sing their praises from the mountaintop.

I have been with Charles Schwab since my first backpacking trip through Europe all because they don’t charge foreign transaction fees or ATM fees WORLDWIDE.

I’ve used my Charles Schwab debit card in Europe, the UK, Cambodia, Vietnam, New Zealand, Japan, China, Tibet…okay you get the picture.

And get this, if the ATM you’re using charges a fee, Schwab reimburses you!

If that doesn’t convince you, then the icing on the cake is that their customer service is excellent, and they offer phenomenal investing tools for the beginners to the advanced.

Sign up for Charles Schwab, like NOW.

58. Pay Your Credit Cards to $0 Every Month

If you’re in a position to do so, pay off your credit cards every month.

Otherwise, you’re just giving the mega-bank your money in interest.

Don’t let the purchases you’ve already made cost you more.

59. Research Balance Transfer Options

If you have any amount of credit card debt, make sure you’re staying alert for any balance transfer options that might be available to you on your cards.

Anytime I’ve made a purchase, or purchases, on a credit card that I know I won’t be able to pay off in one month, I do a balance transfer to another card and get 0% interest for a set time period.

Balance transfers are simple to do, you can do it online, and the fee you pay is almost always cheaper than the interest you would’ve paid letting it sit there racking up interest.

60. Start Investing Today

Investing, to me, used to be this mysterious thing that occurred behind closed doors on the New York Stock Exchange.

I had absolutely no idea what those people were running around like mad doing everyday.

I didn’t understand it, and it just seemed like a mathematically-challenged person like me would never be able to do it.

But today, there are so many ways to start investing as a beginner. With robo-advisors doing all the work for you, giving them a couple dollars is all you need to do to get started.

Popular apps like Acorns and Stash are fantastic for the “set it and forget it” newbie investors.

They require just $5 to start investing and can link to your checking account—automatically investing your spare change!

Other robo-advisor investment accounts are offered by SoFi, Fidelity, and Charles Schwab to name a few.

I invest through a couple different platforms, but my primary one is through Charles Schwab (again, Schwab for the win). They offer Intelligent Portfolios (read: robo-advisor) with a 0% management fee.

In summary, one of the best frugal living tips is: start investing now!

Even if it’s just spare change through Acorns, you will start building a rainy-day fund and/or saving for retirement.

Use Discounts and Cash Back to Live More Frugally

61. Earn Gift Cards and Cash Back Online

Swagbucks — All you do is take online surveys, watch videos or movie trailers, and earn points. Then, redeem those points for gift cards to places like Amazon and Walmart. It’s simple and you can sign-up today and start getting rewards.

Survey Junkie — Survey Junkie works with a few different survey websites and market research companies. It’s simple: you take surveys, and get cash. So while you’re sitting on the subway or pausing between episodes of a TV show, you can start getting paid.

Ibotta — Whether you’re shopping online or in-store, Ibotta has you covered. You can pay using the Ibotta smartphone app at over 50 nationwide or 150 online stores. Within 24 hours, you’ll get cash back on your purchase.

Inbox Dollars — They offer a variety of ways that you can start earning cash back. You can take surveys, watch videos, play games, simply shop online and more! There are so many ways to start earning cash, it’s unbelievable.

62. Hunt for Coupons

Rakuten —Rakuten (formerly Ebates) offers cash back and discounts at some of your favorite online retailers. If you’re looking to purchase something, do it through Rakuten and you can start getting discounts AND making money off purchases.

Groupon — Who doesn’t love a good Groupon find? I’ve used Groupon for everything from massages to kayaking tours.

63. Ask for Gift Cards from Family and Friends

Gift cards used to be shunned upon as a lazy gift for people.

Nowadays though, I don’t know anyone who wouldn’t be elated to receive an Amazon gift card, for example.

We buy so many things through sites like Amazon, that a gift card can help cover the cost of everything from body wash to board games.

So make it easy on your friends and family. Ask for gift cards for websites you like, and use it to buy things that’ll truly bring you joy.

Save Money by Thinking Frugally

64. Obey the 72 Hour Rule

The 72-hour rule is here to prevent you from impulse shopping!

With everything just a click away on Amazon and your favorite online shops, it’s increasingly difficult to not pull the trigger and purchase things immediately.

To prevent you from over-spending and buying needlessly, wait 72 hours before you buy anything, especially more expensive purchases.

Oftentimes, you’ll find that you don’t need or want it as badly as you thought.

65. Use a Budgeting App

Get your finances under control with budgeting apps like Personal Capital.

These apps allow you to link all of your banking, investment, and loan accounts in one place, so you can get a clearer picture of your financial situation.

Also, they track your spending in various categories such as food, entertainment, transportation, etc.

This will help you make a budget and stick to it.

66. Make a Budget

Making a budget isn’t easy, but it’s necessary to achieving financial freedom.

To start, simply track your spending for 2-3 months either through journaling or using apps like Personal Capital.

Now, take a look at where your money went. Figure out which of your spending categories you can reasonably cut down on without significantly changing the way you live.

The idea is that you don’t want to go cold turkey with your spending and feel like you’re punishing yourself.

Set small, reasonable goals and achieve those first. Then move on to the tougher lifestyle changes.

For a more detailed, step-by-step guide to budgeting, check out my 11 simple steps to create a fail-proof budget!.

67. Pay with Cash

There’s something about the physical exchange of cash that makes purchasing things more consequential.

Alternatively, swiping a piece of plastic feels like nothing is happening and money isn’t being spent.

Paying with cash will force you to take notice of where your money goes.

68. Keep the Change

Paying with cash also means you’ll be collecting a lot of change.

Instead of this sitting at the bottom of your purse, keep your change in a jar at home.

After a couple months, bring this bad boy to the bank and chuck it in your savings account.

69. Shop Sales Wisely

Beware of sales everywhere you shop. Just because they’re going on, doesn’t mean you have to buy into them.

It’s always a good idea to keep track of sales for things you need to purchase, but first determine whether they are in fact necessities.

Then, and only then, enjoy a nice sale.

Most sales, however, will lead to buying things you don’t need simply because they were on sale.

70. Hide Your Credit Cards

Credit cards can be deadly to your budgeting and savings goals.

To resist the temptation, take the temptations away!

Keep your credit cards at home when you go shopping, or at the very least take only one with you (preferably, the one with the lowest credit limit).

This will keep you from charging away until your heart’s content.

71. Be Open with Your Partner About What You Spend

Talking about money isn’t easy for everyone, especially if you’re facing significant student loan and/or credit card debt.

But it’s important that you discuss these things with your partner.

According to CNBC, 43% of Americans are not telling their partners about their credit card debt.

Not only does this put an enormous strain on your relationship (money is consistently one of the most common reasons for divorce), but it also makes it more difficult to achieve your financial goals.

Being open and honest with your partner about your financial situation means they can give you the support you need to stay within your budget, pay off debt, and get yourself back on track.

Related Read: 27 Clever Ways to Live Frugally on ONE Income

72. Give Up Bad Habits

Frugal living tips can improve your health as well!

Smoking is a bad habit, and it’s expensive over time.

Alcohol is pricey as well, especially if you are having 2 glasses of wine every night.

Try to cut down on your cigarette and alcohol consumption to reduce these costs. Enjoy them when you can, but don’t overspend.

Track your monthly expenses and see exactly how much you’re spending on these.

73. Invite People Over!

Going out for dinner and drinks all the time can quickly become expensive. If you’re doing this, save yourself the energy drain and money.

Invite people over to yours or arrange a hangout at a friend’s place for dinner, drinks, board games, Cards Against Humanity, or a round of Munchkin.

74. Try “No Spend” Days

Basically, try to go one day a week where you don’t spend anything.

It’s tougher than you think!

But once you’ve tackled a “No Spend” day, try for two, three, or even a week.

Doing this will force you to confront how frequently you’d spend money in a day and figure out areas you can cut back.

Think of “No Spend” days like a recalibration of your spending habits. Afterwards, you’ll be much more aware of where your money goes.

To rock your no-spend challenge, make sure to read my guide all about no-spend challenges and how to set yourself up for money-saving success!

Related Read: How to CRUSH a No-Spend Challenge and Save BIG

75. Lastly, Stay Inspired!

Finally, the biggest financial tip I can give you is to stay motivated and stay inspired.

Our financial goals often seem like impossible mountains to climb. But inspiration is everywhere these days, whether it’s through personal finance podcasts or your local FI (financial independence) groups.

Also, make sure you sign-up for the weekly (no spam) Thrifty Introvert Newsletter to keep you motivated and moving towards financial freedom!

75 Super Simple Frugal Living Ideas with a BIG Impact

Here are more articles about getting out of debt:

- 13 Mistakes That Are Keeping You in DEBT

- How I Paid Off $55,277 in Student Loan Debt (and traveled the world!)

For more ways to save money, check out these articles:

- 21 EXTREME Frugal Living Tips That’ll Save You Thousands This Year!

- 55 Clever Products That Will Save You Money in the Long Run

- Amazon Direct Ship Ultimate Guide: Get FREE Stuff Delivered to You

- Rainy Day vs Emergency Fund: What’s the Difference and Why You Need Both!

- Gross Pay vs Net Pay: How to BUDGET the Right Way